Contents:

While this can boost your potential profits, your losses are greater too. Scroll up to our calculator now and enter your pair, pip amount and lot size to understand just how much 50 pips are worth. You simply find the “found pip value” and divide or multiply that by your account currency’s exchange rate and the questioned currency. Pips are how you measure movement in a currency pair, standing for ‘point in percentage’. The value of a pip changes depending on the pair you are trading.

You will need to do your own research, remember that markets can move in a direction that can damage your position, and never trade with more money than you can afford to lose. In forex, pips are the crucial element that, ultimately, measure a trader’s profit or loss. They are the smallest decimal point of a quoted currency price, normally at the fourth number after the decimal point (0.0001), however, the second for JPY (0.01). If youraccount currency and the quote currency are different,it gets slightly more complicated.

What is a Pip in Forex?

In most forex currency pairs, one pip is a movement in the fourth decimal place (0.0001), so it’s equivalent to 1/100 of 1%. Pips have a few different uses in forex trading, so you’ll see the term pop up again and again. Let’s take a look at how pips are used for calculating profit and loss, the spread and position size.

Calculating Profits and Losses of Your Currency Trades – Investopedia

Calculating Profits and Losses of Your Currency Trades.

Posted: Sat, 25 Mar 2017 20:01:56 GMT [source]

It determines your profit, and the price of an asset at any given time.Optimizing your trade entry Intermediate 3-minute read Getting your entries right is crucial to successful trading. This will also depend on the currency pair you decide to trade. Use the pip value calculator above by entering the currency pair, number of pips and lot size to quickly calculate how much 50 pips are worth in real time.

What is a Pipette/Point?

Instead, you will make more or fewer pips depending on the market movement. If the market moves more, you will make more pips, if move less, you will make less pips on your trading account. The Smallest decimal price measurement in the exchange market is known as Pip. His team is also behind the Axi VIP portal, dedicated to continuing to guide and educate traders. In some cases, lower value cryptocurrencies can utilise pips as units to measure cents or fraction of cents movement.

We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey. So, when trading 10,000 units of GBP/JPY, each pip change in value is worth approximately 0.813 GBP.

How much is a pip worth?

There are many beginners or small investors who wish to use the smallest possible Lots sizes. In contrary to the Mini Lots that refer to 10,000 units, traders are welcome to trade 1,000 units or 0.01. For example, when someone trades USD/CHF with a Micro Lot the trader basically trades 1,000 USDs.

Using the pip value calculator above will help you see the value of a pip in a matter of seconds. As the largest financial market globally, Forex trading is one of the most popular investment avenues for many. The liquidity and huge trading volume make Forex trading an option worth exploring. In Forex trading, you can take long or short positions based on expectations of the market rising or falling. Long or buy positions are maintained when traders expect currency pair prices to increase in the future. In FX markets, the spread would be represented in the difference between these numbers would be the spread, measured in pips.

Pip means “Percentage in Point” and is the measurement of the minimum price change of a currency pair. It represents the change of one currency against another, both of which are represented in a Forex pair. Pips, for the majority of pairs, represent the fourth number after the decimal point (0.0001), while for others, pip measures the second number after the decimal point (0.01).

As each currency has its own relative value, it’s necessary to calculate the value of a pip for that particular currency pair. Don’t even think about trading until you are comfortable with pip values and calculating profit and loss. The foreign exchange, or Forex, is a decentralized marketplace for the trading of the world’s currencies. The Japanese yen is an exception because its exchange rate extends only two decimal places past the decimal point, not four. It’s often challenging to count pips in Forex, but it’s crucial for your strategies and plans.

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

Some how to calculate pips on forexs have their pip at the 4th decimal while some in the 2nd. The fractional pip, or Pipette, always follows the pip location, so it would be in the 5th and 3rd decimals respectively. Notice that this currency pair only goes to two decimal places to measure a 1 pip change in value .

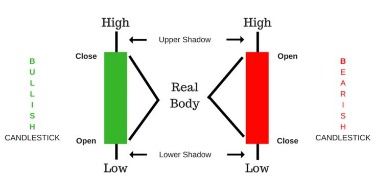

Pip and pipette

Learn more about developing your own forex trading strategy, such as swing trading, day trading and forex scalping. Most forex brokers allow a very high leverage ratio, or, to put it differently, have very low margin requirements. This is why profits and losses vary greatly in forex trading even though currency prices do not change all that much — certainly not like stocks.

It is called nano https://g-markets.net/ or “pipette.” According to the nano pip Forex definition, it represents the price change of the fifth number after the decimal point, instead of the fourth one. In Forex, the PIP value determines risk; a trader needs to know PIP rates and the likely direction of currency price fluctuation to attain a good position. Since previously, most Forex brokers provided only 2 decimal places (example – USDJPY) and 4-digit (example – EURUSD) quotes, the minimum price movements were 0.01 and 0.0001, respectively. The exchange rate ratio of the account currency to the currency in which we’re calculating the value of 1 point. Now let’s add 1 pip value for each currency pair and calculate its value for a standard volume of 1 lot.

So, a single whole unit pip is .01 rather than the .0001 for other currency pairs. Fractional pips are smaller than pips and, thus, a more precise measurement. They appear as a superscript numeral at the end of a quoted exchange rate. “Pip” is an acronym for percentage in point or price interest point.

Hyperinflation refers to a period where prices of goods and services are increasing excessively and in an out-of-control fashion. When FX movements become extremely high, pips lose their utility. Since FX markets are highly liquid with a high volume of transactions, the units of measurement for transactions are important. Furthermore, since units are typically quite small, a larger number of decimals are needed to capture variations in exchange rates to a greater degree of accuracy.

It measures the changes in the exchange rate of a given currency pair. A pip is the change in the fourth decimal of the exchange rate, except with JPY pairs where it is the second decimal. Using these small units to measure price movement can also protect inexperienced traders from big losses.